Introduction:

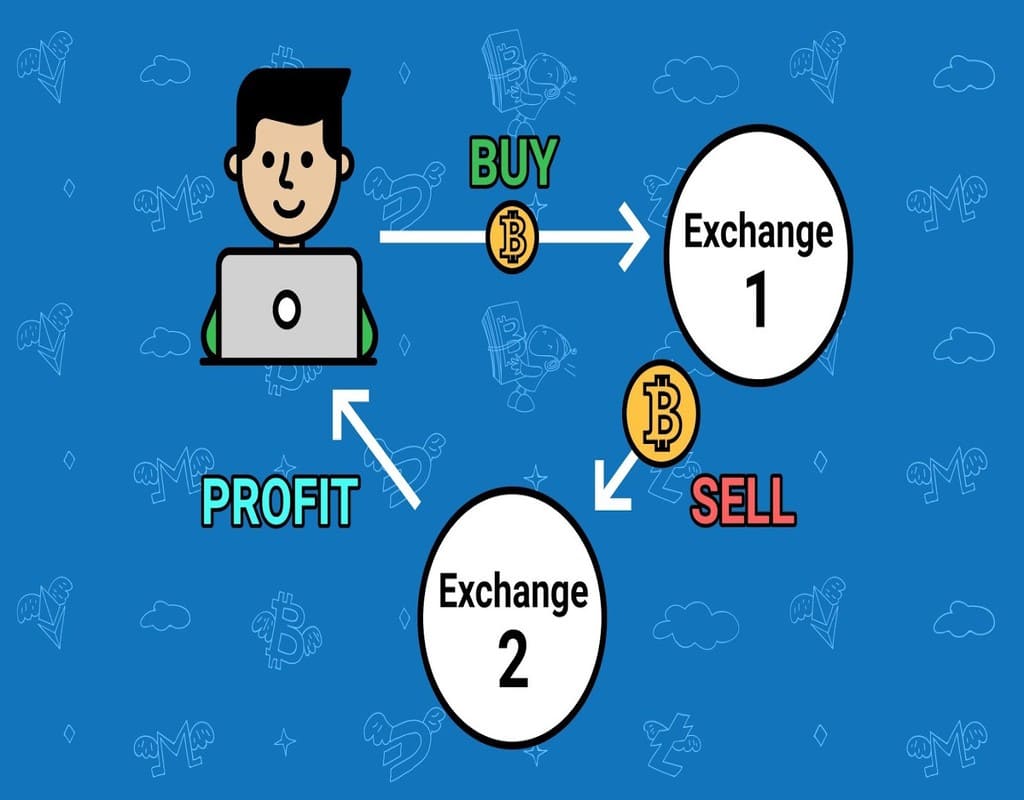

Cryptocurrency arbitrage is a trading strategy that involves buying and selling cryptocurrencies on different exchanges to profit from price discrepancies. The process involves buying a cryptocurrency on one exchange where it is cheaper and then selling it on another exchange where it is more expensive. However, finding crypto arbitrage opportunities can be challenging, especially for beginners. In this article, we will discuss how to find crypto arbitrage opportunities and some tools that can assist in this process.

Understanding Crypto Arbitrage Before diving into how to find crypto arbitrage opportunities,

it is important to understand the concept of crypto arbitrage. Crypto arbitrage is a strategy that exploits the price differences between different cryptocurrency exchanges. The main aim of this strategy is to profit from the price discrepancies by buying a cryptocurrency on one exchange where it is cheaper and then selling it on another exchange where it is more expensive. The price discrepancies are usually small, and the profit made is also small. Therefore, to make significant profits, traders usually execute multiple trades.

How to Find Crypto Arbitrage Opportunities

- Research Cryptocurrency Exchanges: The first step in finding crypto arbitrage opportunities is to research different cryptocurrency exchanges. Look for exchanges that offer the cryptocurrencies you are interested in trading and compare their prices. Some popular cryptocurrency exchanges include Binance, Coinbase, Kraken, and Bitfinex.

- Use Arbitrage Bots: There are several arbitrage bots available that can help traders identify arbitrage opportunities automatically. These bots are programmed to scan different cryptocurrency exchanges to find price discrepancies and execute trades automatically.

- Monitor Price Movements: To find crypto arbitrage opportunities, traders need to monitor price movements across different exchanges. One way to do this is to use cryptocurrency price tracking websites such as CoinMarketCap and CryptoCompare. These websites provide real-time prices for different cryptocurrencies on different exchanges.

- Analyze Trading Volumes: Another way to find crypto arbitrage opportunities is to analyze trading volumes on different exchanges. Low trading volumes on some exchanges can lead to price discrepancies, which traders can exploit for profit.

- Look for News and Events: Crypto arbitrage opportunities can also arise from news and events that impact the cryptocurrency market. For instance, a new partnership between a cryptocurrency project and a major company can lead to price discrepancies on different exchanges.

Are there still arbitrage opportunities in crypto?

Yes, there are still arbitrage opportunities in crypto. Arbitrage is a strategy that involves buying and selling an asset at different prices in different markets to make a profit. With the cryptocurrency market being decentralized and global, there are often price discrepancies between exchanges, creating opportunities for arbitrage.

Is crypto arbitrage still profitable in 2022?

While there is no guarantee of profitability in any trading strategy, crypto arbitrage can still be profitable in 2022. As long as there are price discrepancies between exchanges, there will be opportunities for arbitrage. However, it’s important to note that arbitrage opportunities can be short-lived and may require quick action to capitalize on them.

Is crypto arbitrage bot profitable?

A crypto arbitrage bot can be profitable if it is well-designed and properly maintained. These bots use algorithms to scan multiple exchanges for price discrepancies and execute trades automatically. However, they also come with risks and limitations, such as the potential for technical errors and the inability to react to market changes that may affect prices.

How do I get started in crypto arbitrage?

To get started in crypto arbitrage, you will need to have accounts on multiple cryptocurrency exchanges and a way to transfer funds between them quickly and cheaply. You will also need to be familiar with market trends and have the ability to monitor prices and execute trades quickly. There are also various tools and software available to help with finding and executing arbitrage opportunities.

Best crypto arbitrage scanner

A crypto arbitrage scanner is a tool used to scan multiple exchanges for price discrepancies and potential arbitrage opportunities. Some popular options for crypto arbitrage scanners include Crypto Arbitrage Trader, Blackbird, and HaasOnline. The best option will depend on individual preferences and needs.

Cryptocurrency arbitrage website

A cryptocurrency arbitrage website is a platform that provides information on price discrepancies between different cryptocurrency exchanges, helping users identify potential arbitrage opportunities. Some popular cryptocurrency arbitrage websites include CoinArbitrageBot, Crypto Arbitrage Now, and ArbitrageCrypto. These websites typically offer real-time data and tools to help traders take advantage of arbitrage opportunities.

Crypto arbitrage signals

Crypto arbitrage signals are notifications or alerts that indicate a potential arbitrage opportunity based on price discrepancies between exchanges. These signals can be delivered through various channels, such as email, SMS, or social media. Some popular providers of crypto arbitrage signals include CryptoPing, Cryptohopper, and Shrimpy.

Is crypto arbitrage profitable?

Crypto arbitrage can be profitable, but it also comes with risks and limitations. Profitability depends on market conditions, the effectiveness of the arbitrage strategy, and the ability to execute trades quickly. Additionally, the fees associated with transferring funds between exchanges and executing trades can eat into profits.

Triangular arbitrage crypto

Triangular arbitrage is a strategy that involves taking advantage of price discrepancies between three currencies on different exchanges. For example, if there is a price difference between Bitcoin, Ethereum, and Litecoin on three different exchanges, a trader could buy Bitcoin on the first exchange, trade it for Ethereum on the second exchange, and then trade the Ethereum for Litecoin on the third exchange to make a profit. This strategy requires careful monitoring of prices and execution of trades in a timely manner.

Arbitrage trading software

Arbitrage trading software is a type of tool that uses algorithms to scan multiple exchanges for price discrepancies and execute trades automatically. Some popular options for arbitrage trading software include Blackbird, HaasOnline, and Cryptohopper. These tools can help traders identify and capitalize on arbitrage opportunities quickly and efficiently.

What is crypto arbitrage?

Crypto arbitrage is the practice of taking advantage of price differences between different cryptocurrency exchanges or markets to make a profit.

Are there still arbitrage opportunities in crypto?

Yes, there are still arbitrage opportunities in crypto, although they may be more limited than in the past due to increased competition and efficiency in the market.

Is crypto arbitrage still profitable in 2022?

It is possible to make profits from crypto arbitrage in 2022, but it requires careful analysis and execution of trades. The profitability of crypto arbitrage depends on various factors such as market volatility, exchange fees, and transaction times.

How do I get started in crypto arbitrage?

To get started in crypto arbitrage, you need to research and analyze different exchanges and markets to identify price discrepancies. You will also need to have accounts on multiple exchanges and be able to quickly execute trades.

What is the best crypto arbitrage scanner?

There are several crypto arbitrage scanners available, and the best one for you will depend on your specific needs and preferences. Some popular options include Crypto Arbitrage Trader, ArbiSmart, and Token Metrics.

What is triangular arbitrage in crypto?

Triangular arbitrage is a type of crypto arbitrage that involves taking advantage of price discrepancies between three different cryptocurrencies. This is done by buying one cryptocurrency on one exchange, selling it for another on a second exchange, and then using the proceeds to buy a third cryptocurrency on a third exchange.

Are there any cryptocurrency arbitrage websites?

Yes, there are several cryptocurrency arbitrage websites that provide real-time data on price discrepancies between different exchanges and markets. Some popular options include Coinarbitragebot, CryptoTriangular, and Coinigy.

Is it possible to use a crypto arbitrage bot to make profits?

Yes, it is possible to use a crypto arbitrage bot to automatically identify and execute trades based on price discrepancies. However, it is important to thoroughly research and choose a reputable and reliable bot provider.

What is arbitrage trading software? A: Arbitrage trading software is a type of computer program that helps traders identify and take advantage of price discrepancies between different exchanges and markets. This software can be used for various types of assets, including cryptocurrencies.

Is crypto arbitrage a team sport?

Crypto arbitrage can be done individually or as a team, depending on the size and complexity of the arbitrage opportunities. Working in a team can help to identify and execute trades more quickly and efficiently, but it is important to have a clear and agreed-upon strategy and communication plan.

Conclusion:

In conclusion, crypto arbitrage can be a profitable trading strategy when done correctly. Finding arbitrage opportunities requires research, monitoring price movements, analyzing trading volumes, and keeping an eye on news and events that impact the cryptocurrency market. Additionally, traders can use arbitrage bots to identify opportunities automatically. It is important to note that crypto arbitrage involves risks, and traders should only invest what they can afford to lose.